Scams, bad investments, and everything in between

Scams

If we promised to make you money, running Nisba would be very easy.

But we don’t.

We educate people on how to invest, not what will make them rich. Unfortunately, like many things in life, when investing is done properly, it’s slower, less exciting, and people can lose interest. Hype sells far better than patience.

That said, when we repeatedly see things done badly, or questionably, do we have a duty to call it out?

We’re not entirely sure. But we do feel a responsibility to help people think more clearly.

One of the hardest parts of investing is distinguishing between a scam and a bad investment. Not everything that loses money is a scam, and not everything that looks professional is legitimate. Sometimes, things even start with good intentions and slowly turn sour.

Below are a few real-world examples to help illustrate that difference.

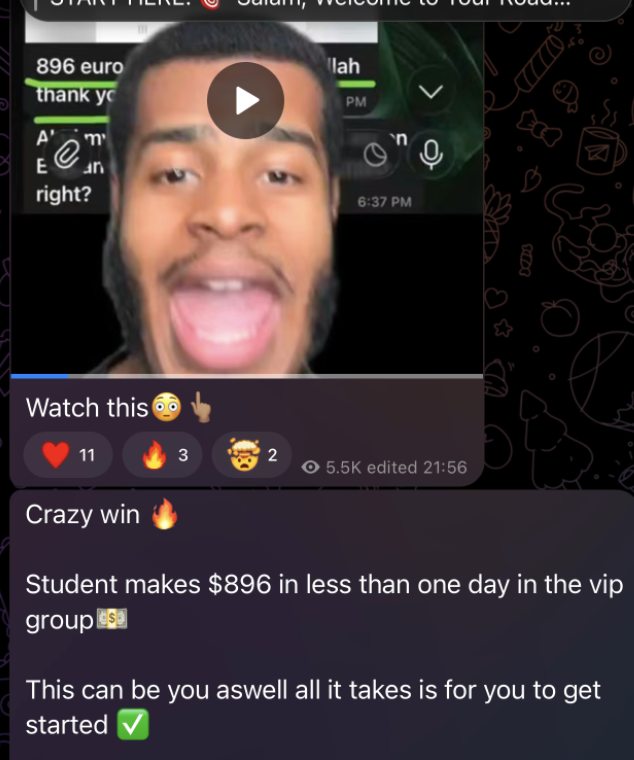

Example 1: “Fast money” trading content

From time to time, we see trading content aimed specifically at Muslims that promises big money, quickly, and in a halal way, often through signals that can be copied.

This kind of content should always be approached with caution.

Trading itself is not automatically haram, but how it is presented and sold matters. When potential returns are highlighted without a clear discussion of risk, losses, and uncertainty, people are not being given the full picture. In reality, most retail traders lose money, especially when copying trades without understanding position sizing, risk management, or probability.

Another major concern is the promotion of non-UK-regulated brokers (which we have seen promoted in certain instances). If a platform is not authorised by the FCA, there is:

-

No FSCS protection

-

No Financial Ombudsman

-

Very limited recourse if something goes wrong

Funds may not be properly protected, and withdrawals can be delayed or blocked with little accountability.

Using Islamic language or positioning to build trust carries additional responsibility. In Islam, transparency and honesty are not optional. Omitting material risks or implying certainty where none exists is not aligned with Islamic ethical principles.

Common warning signs:

-

Emphasis on how much others made in a short time

-

Little or no discussion of risk or losses

-

Being pushed towards a non-UK-regulated broker

-

Multiple hoops to jump through before you “start earning”

Likelihood of being problematic: Very high

Example 2: UK property investing platforms

Some platforms offer “halal” investing into UK property. At Nisba, we make a point of testing platforms ourselves before ever speaking about them publicly. In some cases, that’s exactly why we don’t speak about them.

Common warning signs we look out for:

-

Directors with multiple past businesses that have gone into administration

-

A growing number of negative reviews

-

Websites or platforms going offline unexpectedly

-

High staff turnover and short employee tenures

None of these alone prove anything, but together, they raise questions.

Likelihood of being problematic: Medium to high

Example 3: Business financing platforms

Some Shariah-compliant business financing platforms aim to fund SMEs while offering investors returns. These models are inherently higher risk.

Recently, we’ve seen increasing concern around:

- Poor communication

- Delays or missed payments

- Regulatory changes

- A large proportion of deals under stress at the same time

Importantly, this does not automatically mean fraud. It may indicate poor underwriting, weak risk management, or simply bad execution, all of which still matter deeply for investors.

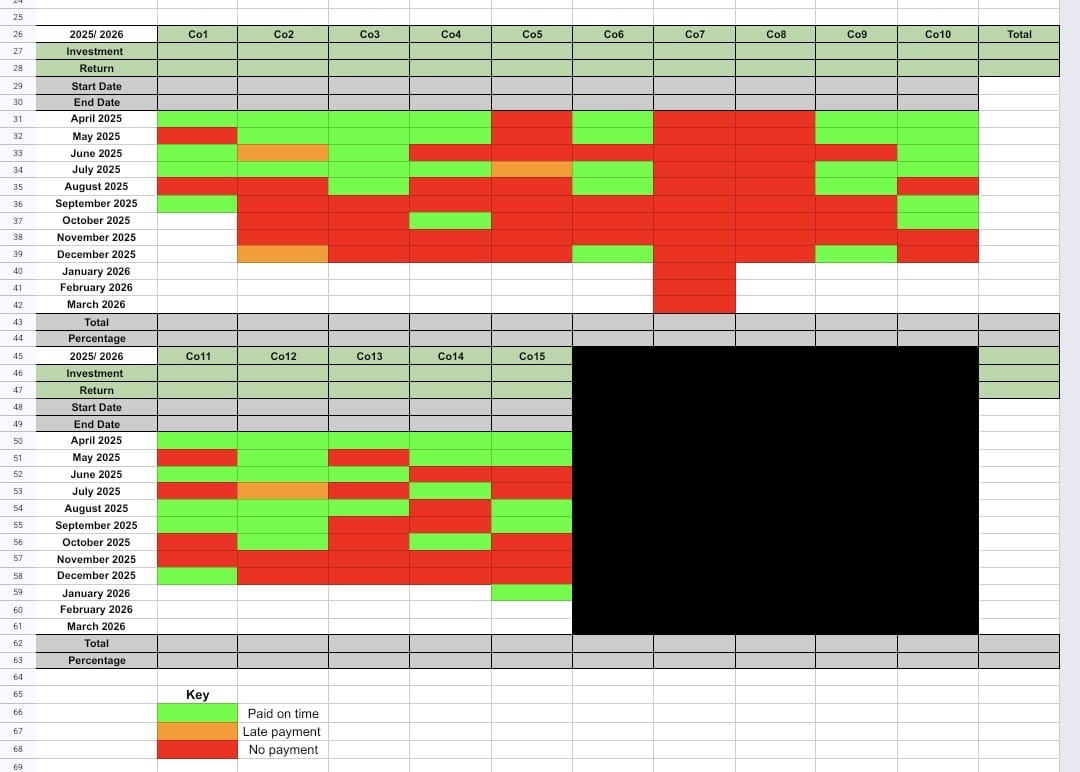

Interestingly, one community member shared a sheet with us outlining their participation in a number of deals on a particular platform, along with the issues they have experienced over time (see above).

We have also seen separate communications from others raising similar concerns. What stands out is not any single issue, but the volume of deals experiencing difficulties at the same time.

This naturally raises questions around underwriting standards, risk management, and operational oversight. It’s important to stress that challenges like this do not automatically imply wrongdoing, but they do warrant closer scrutiny and clearer communication.

What makes situations like this worse is silence. Even when investments go wrong, clear and frequent communication makes a huge difference. Losses with transparency are very different from losses with confusion.

Likelihood of being problematic: Low to medium

(With concerns centred more around management and communication than intent)

A final reminder

Not every investment that loses money is a scam.

For example, some professionally run funds are currently losing money faster than expected, but communication has been clear, risks were disclosed upfront (to some extent), and investors understand what’s happening.

Saudi equities: what this actually means

You’ll soon be able to invest directly into publicly listed companies in Saudi Arabia.

This may sound more exciting than it actually is.

Investors have been able to access Saudi-focused funds for years, and performance over the past few years has been relatively flat. Much of the market is concentrated in familiar sectors, energy, telecoms, banks and utilities, rather than highly innovative or fast-growing businesses.

Saudi Arabia is often spoken about as a future economic powerhouse, but much of that expectation is already reflected in prices. That doesn’t make it a bad market, but it does mean the “easy growth” narrative is often overstated.

It’s also worth remembering that not every listed Saudi company is Shariah-compliant. Direct access does not remove the need for screening: financial ratios, business activities, and governance still matter.

And even if you wanted to invest directly, practical barriers remain. Most UK brokers do not offer access to Saudi equities, so availability will be limited in practice.

As with most things in investing, the headline sounds exciting, the reality is more nuanced.

Nisba News

Events

We’ve got a few free, online sessions coming up over the next couple of weeks.

These events are designed to help you build understanding, ask better questions, and see how investing works in practice, without hype, shortcuts, or promises of returns.

Whether you’re just getting started or looking to deepen your thinking, you’re welcome to join.

Sign up, if you're interested!

Uni Talks

We’ll be running a couple of in-person talks at the University of Greenwich and Cambridge University ahead of Ramadan.

If you attend either university, keep an eye out, we’ll be sharing more details very soon.

Stock Competition

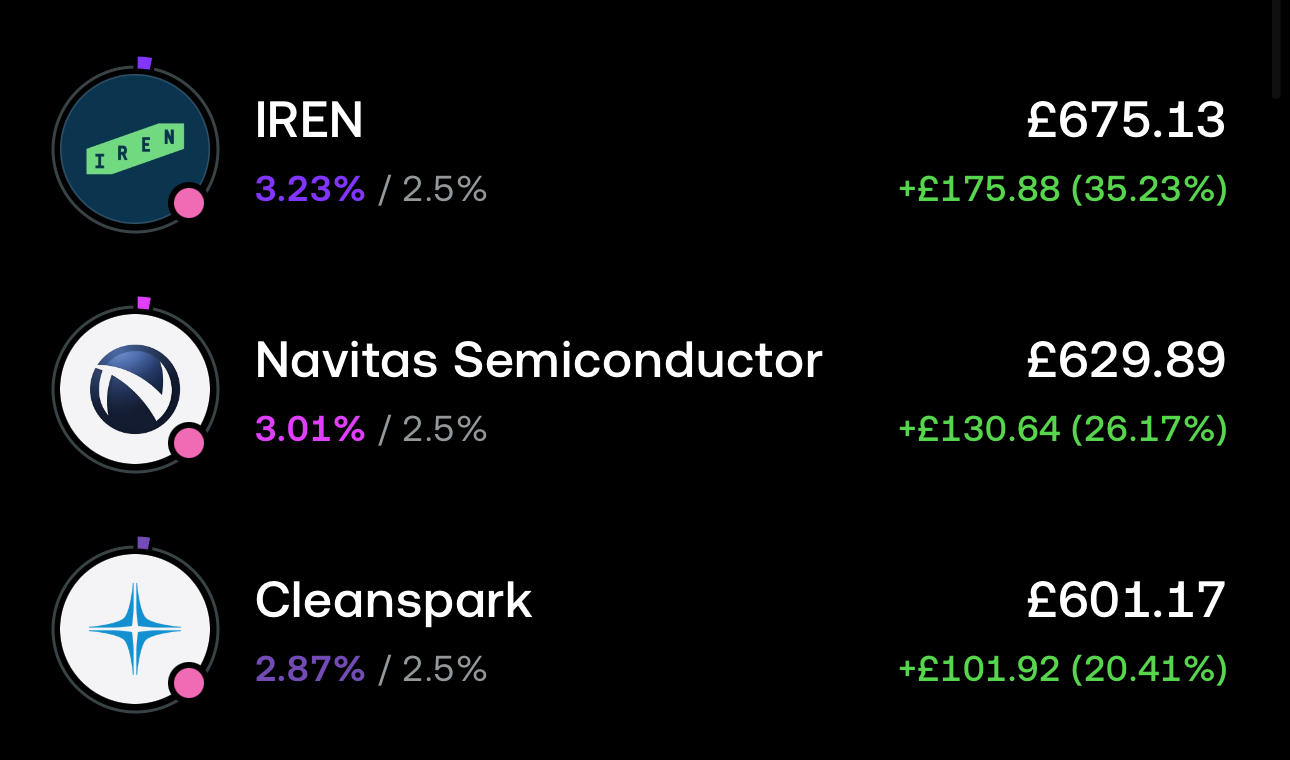

The Nisba January Stock Competition is well underway.

If you’d like to follow along, see the picks, and stay up to date with how things are progressing, check out the Nisba Challenges WhatsApp group.

Nisba Playbook

We’ve just completed the latest and most comprehensive edition of the Nisba Playbook, our step-by-step guide to halal investing, built specifically for UK Muslims.

This is the resource we wish existed when we started:

-

Clear explanations, not jargon

-

UK-specific accounts, tax rules, and allowances

-

A structured framework to help you move from intention to action

-

No shortcuts, no promises, just understanding

For the first time, we’ll also be printing physical copies of the Playbook.

You can pre-order your copy now, with expected delivery in the first half of February 2026.

Market Views

It’s been a firm start to 2026.

So far this year:

-

Bitcoin is up just over 7%

-

The FTSE 100 around 2%

-

Silver has risen by more than 20%

-

Gold is up roughly 7%

-

The S&P 500 is up a little over 1%

As I’ve mentioned in previous newsletters, I tend to pay attention to longer-term trends rather than short-term noise. That said, some areas, particularly certain commodities, are starting to look stretched.

In situations like this, I don’t mind doing a bit of de-risking within asset classes. For example, trimming exposure to silver and reallocating towards gold. That may mean missing out on further upside, but trying to buy the exact bottom and sell the exact top is largely a distraction. You will almost never get it perfectly right, and that is fine.

Geopolitics adds another layer of uncertainty. With the US appearing to alienate itself in certain areas, we could see USD weakness come into play. On the other hand, it is equally possible that capital is pulled towards the US, leading to dollar strength instead. It is a difficult call, and certainty here is often overstated.

Given the erratic nature of geopolitics more broadly, it may also make sense to slightly de-risk equity exposure. Not in a dramatic way, but as part of sensible portfolio maintenance. To put things into perspective, if i was investing for 20 years, even if i thought there would be a market correction in 2026, i wouldn't alter my equity exposure for that goal.

Ultimately, I still come back to the same principle. Having an asset allocation that fits your risk profile and goals, then making small, thoughtful adjustments over time. That matters far more than any single market view and keeps investing grounded, disciplined, and just interesting enough to stay engaged.

Thanks for reading

Jzk

Ahmad & Adel

Responses