New Funds, Lower Yields and a Reality Check

Coming up:

- A little point of reflection

- Wahed: New funds

- Cur8 Income Fund

- Nester new deals

- Nisba updates

- Market View

A little point of reflection

Now i'm not a gambling person, as you can imagine. But if i had to take a long-term view if:

- Equity markets

- All commodities,

- Property

- Most assets to be honest...

Are going to be higher in 10 years time, i'd take that bet every time. The difficult part of investing isn't making money, it's getting your asset allocation right for you goal and understanding how risk and return works. Then things become simple, albeit a bit boring. Unfortunately there's a bit of a trend to make investing a bit like gambling, from which many people benefit, but not you.

Wahed came out with a couple new funds

Wahed Dow Jones Islamic World UCITS ETF (DJIW)

Wahed S&P 500 Shariah UCITS ETF (SPWI)

This is good, more Muslim led funds. We want this. Also, we get to deal with all the boycott issues that we had on the previous funds right?

Beyond standard Shariah compliance screens, Wahed applies an additional discretionary Islamic values-based screen. This screen references four independent, well-recognised sources that flag companies linked to specific, serious human-rights risks:

1. OHCHR (UN Office of the High Commissioner for Human Rights)

2. AFSC Investigate database (American Friends Service Committee)

3. UFLPA Entity List (Uyghur Forced Labor Prevention Act)

4. KLP Council on Ethics Exclusion List (Norway’s largest pension fund)

Unfortunately, not quite:

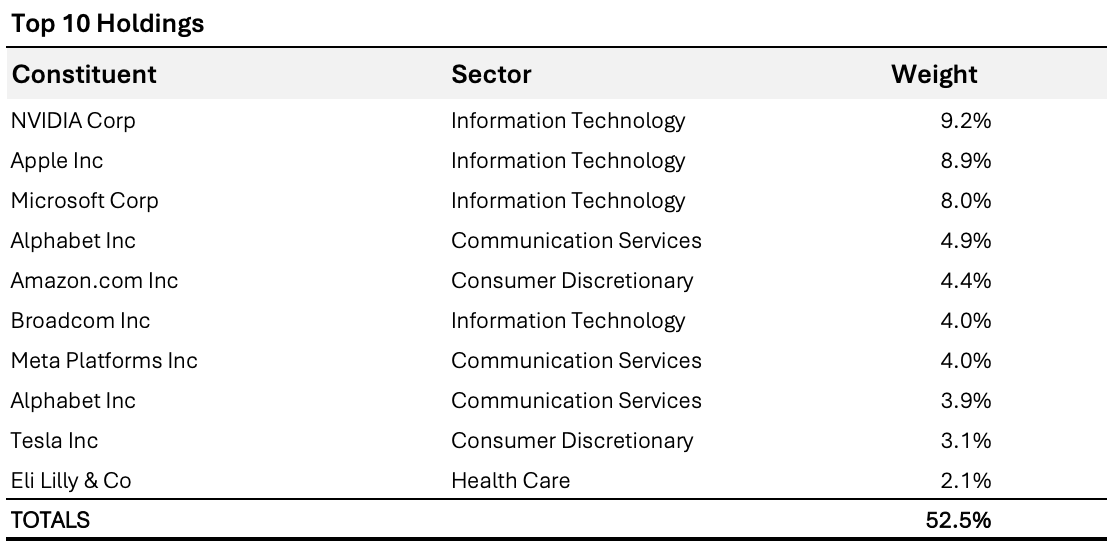

SPWI top holdings:

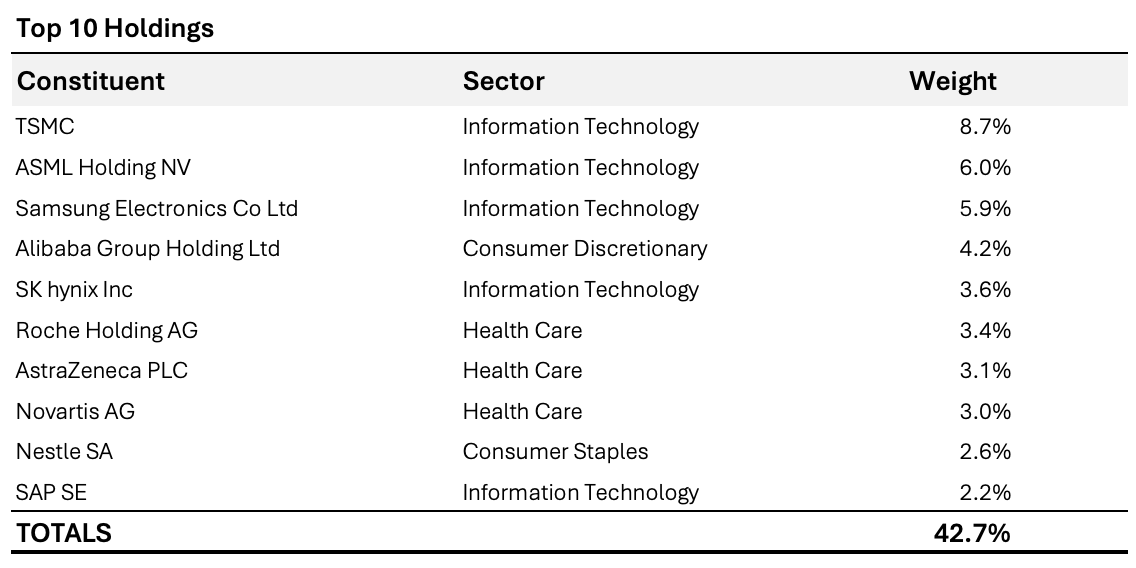

DJIW top holdings:

But they took a step in the right direction, and more people are working on a solution.

Fees are 0.49% so i will put that into the average bucket. I haven't seen this fund on any platforms yet, seemingly the only way to enter at the moment is to use Waheds robo-advisory service. I assume it will be added at some point to other platforms.

This isn’t a recommendation, just an overview of the new Wahed Funds.

Cur8 drops return on GBP income fund

We are down from 7.5% to 7% (both gross of fees, 6.75% net for non-members). Boo, we want higher returns. But if we compare it to what you're getting on an islamic savings account (not that they are compar

able as it's a different level of risk) it's still decent. Islamic savings accounts rates have been coming down, in line with interest rates. So this isn't too surprising.

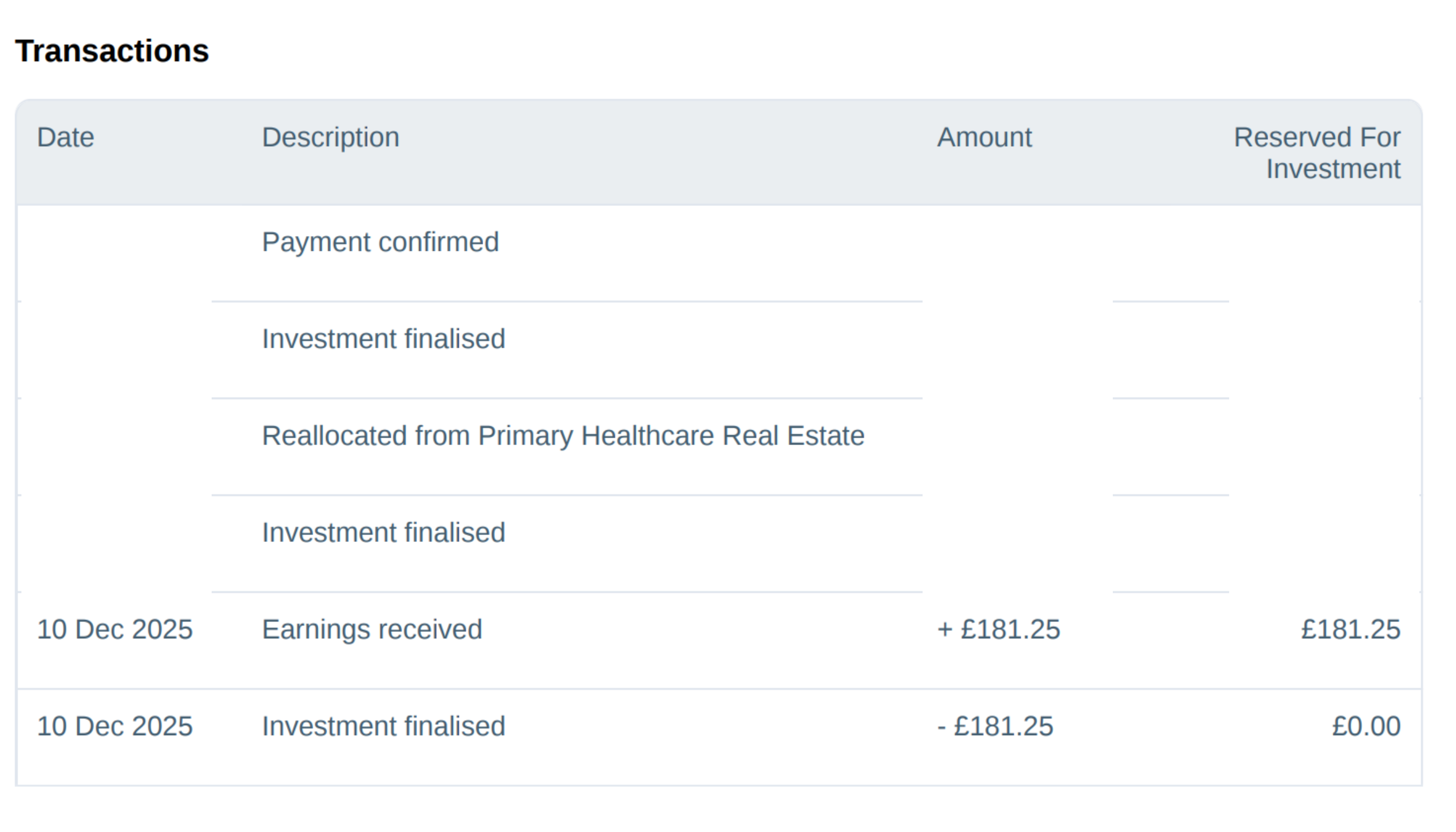

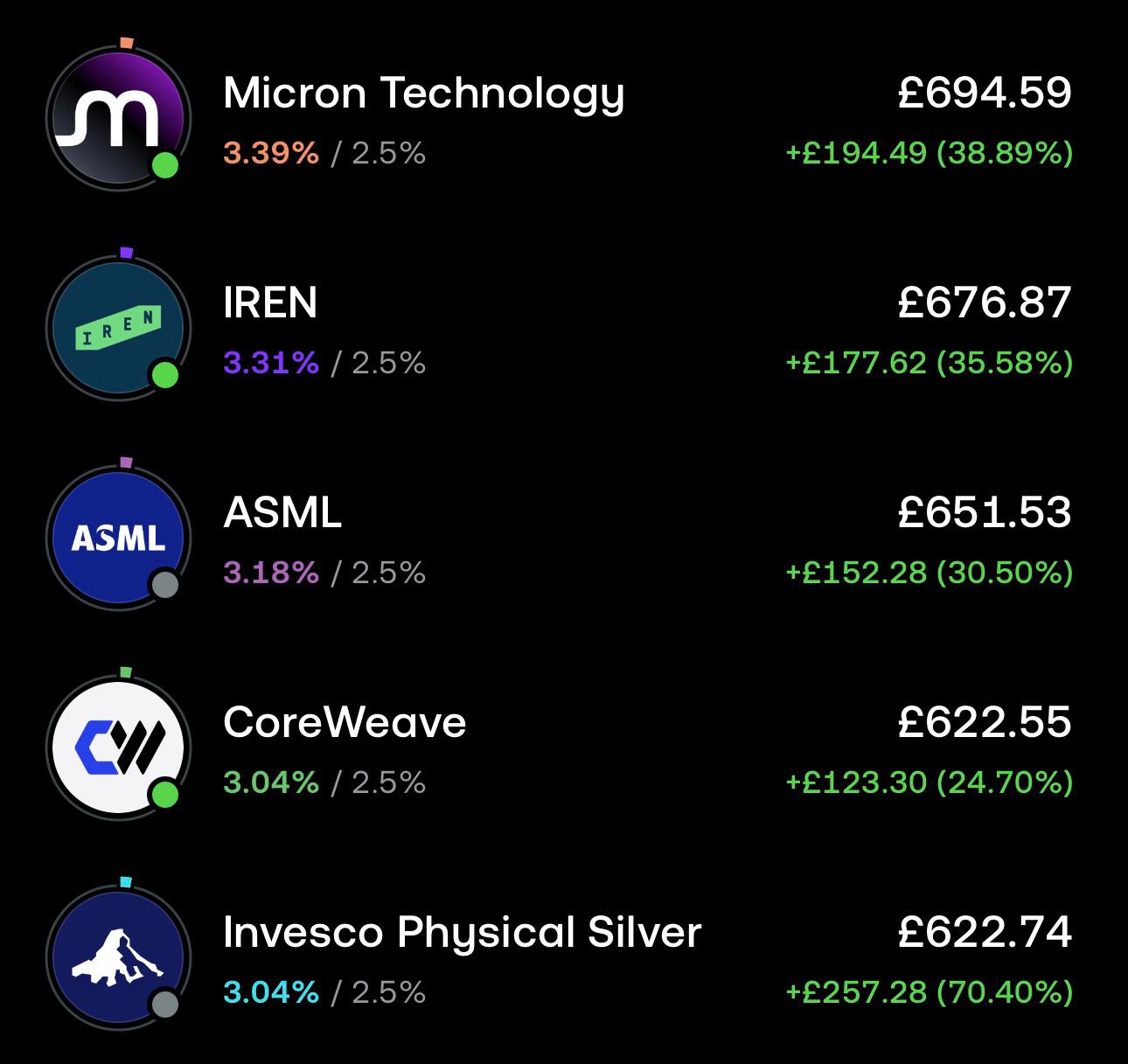

Assessing the risk of this fund is tough, there's quite a bit of literature around it, but really getting to the bottom of just how much risk you're taking on is almost impossible to quantify. In case you're interested how our investment into this fund is going:

Up to the latest profit distribution, our investment into the GBP income fund delivered a 1.8% return to date, equivalent to around 6.4% on an annualised basis. We have been in for around 6 months.

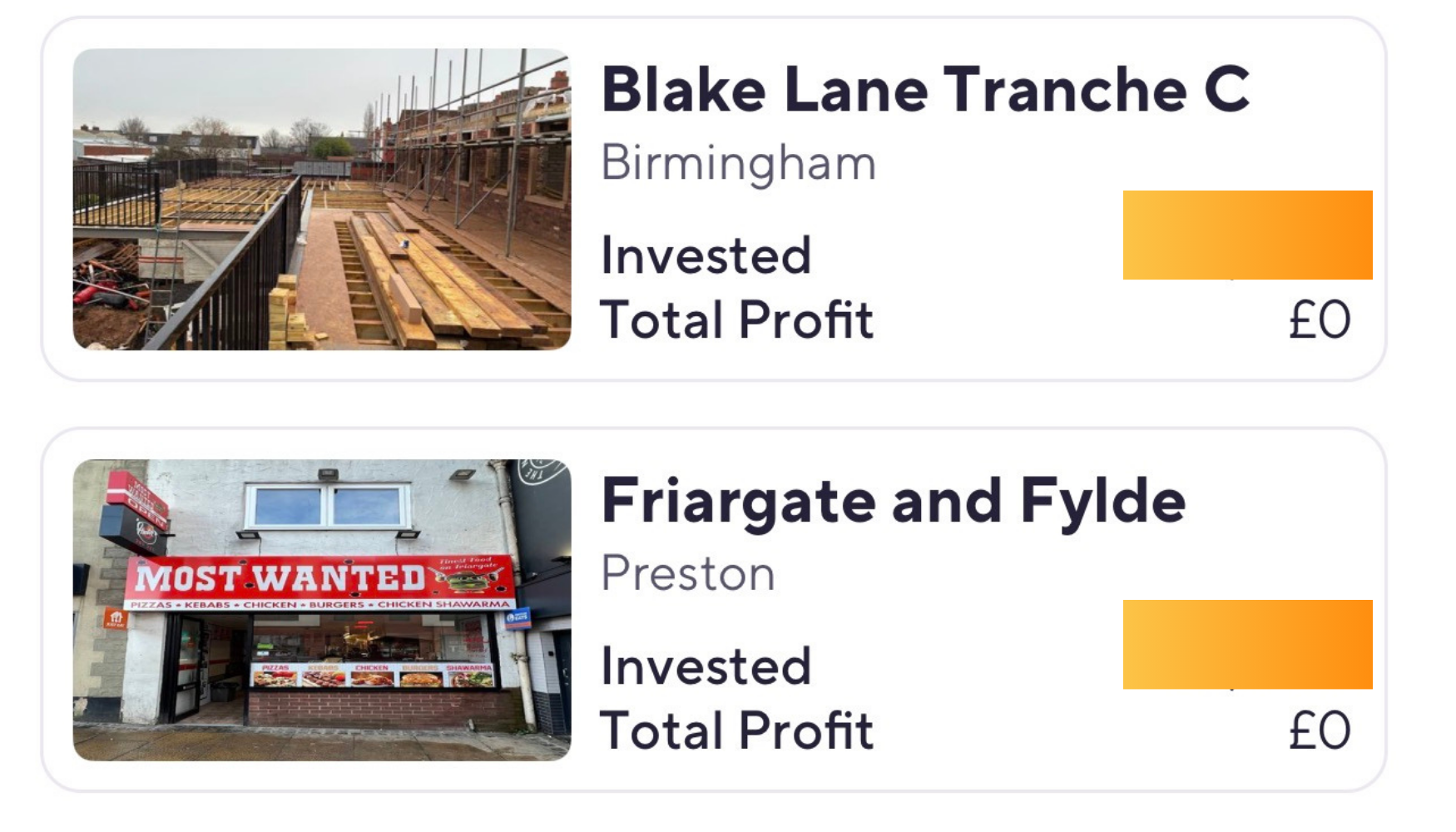

Nester had a couple new deals this month

Both sold out in under a minute based on my watch. Interestingly Blake Lane was 9% and we haven't seen a 9% deal in a while. Friargate and Fylde was 8.25% which is still a great level or return but I do get the feeling the average level or return for new deals is going down.

Investing in single deals is nice because assessing the risk becomes easier, but it doesn't help when it comes to diversification.

We had a winner for the Nisba Jan Stock Picking competition

It was brother Arif, so inshallah he enjoys his silver bar prize and his nisba hoodie. Unfortunately, it not worth as much as it was last week.

New competition will be announced soon, we are just thinking of where we can host it... but it will 99% be on discord. DISCORD?

Nisba is on discord

Our Whatsapp chat was getting hard to moderate, slowly we will move over to discord. Feel free to beat the rush: https://discord.gg/hRK6Ppdvgm

Sorry if you prefer whatsapp, i do too. For now, it's not suitable given the community size. The whatsapp will stay open for now but you have been warned!

The Nisba Academy can now be joined and started any time!

Our aim at nisba is to educate muslims on how to invest. We do that all the time. But if i tell you how to lift a weight, doesn't mean you will go to the gym. The Academy is designed to be practical, so you end with a plan you will put into action as you go along. Check it out here: https://www.nisba.co.uk/academy

Halal Investing Playbook print is arriving tomorrow!

Thanks to those who have preordered their physical copy of the Halal Investing Playbook, it's due to arrive tomorrow. Inshallah it will be shipped out soon. Other than this book being a real gem (and a great Eid gift), you'll hold a piece of history as it's our first edition. Pre-order your copy for delivery in the coming weeks. https://www.nisba.co.uk/playbook

My market view

A choppy week, more choppy weeks to come. If only investing was all smooth sailing. We saw big drops in commodities, crypto, but equities were ok. Seems the issues with Iran has got a bit quiet, but there's no smoke without fire, somethings brewing (purely my personal view)... I'll tell you something though, even if there is no war between the US and Iran, that Trump, he'll have some more exciting stuff moving the market rapidly over the next few months. If I couldn't handle volatility, i'd probably step away from the market for now. But thats not how I work, volatility is part of the game, and the game is long term. And when its short term, I dial back the risk.

I can't say I'm particularly bullish on any asset class at the moment, but when the alternative is USD or GBP, I think, relatively speaking maybe I am bullish...

Thanks for reading

Jzk

Ahmad & Adel & the Nisba Team

Responses