Best ISA, Gold and War

This week's newsletter covers:

- Analysing an Individual Stock - Monday 26th January, 9pm

- Our reviews of some of the best ISAs we've found

- Changes happening in the Islamic finance space

- What do about gold and silver

SSS2 - Monday 26th January, 9pm

Previously on Shariah Stock Spotlight we invited an equity analyst to go through a single stock "Ferrari".

Let's just say, it went down so well, we had to get him back for episode 2. (n.b. Don't worry if you didn't attend the first session, each episode is stand-alone)

Join us tomorrow night at 9pm. Sessions are not recorded.

Top picks: ISAs

Individual Savings Accounts are just accounts.... so how can you have a 'best'?

- Fees

- Design

- Customer service

- Mobile app

- Choice of investments

- Rules

This is the general criteria we use when looking at different platforms. It's a bit like picking a supermarket. Convenience is key as well as price and choice. Same goes for your brokerage account. So let's have a look at some of the best platforms to use for different ISAs.

Our Pick for a Stocks & Shares ISA: Trading 212

Trading 212 takes the top spot for its low costs, friendly design, and broad range of choices. You can open an account with as little as £1, and the platform charges no trading commissions or platform fees. With some of the lowest FX rates on the market and fast, flexible withdrawals, it's definitely one to consider. It also has a really clean and user‑friendly design (it recently updated its interface, then reverted after community feedback).

You can also access a range of Islamic ETFs, individual stocks, and commodities such as gold. However, it’s worth noting that Trading 212’s offering is limited to ETFs - mutual funds like the HSBC Islamic Fund are not available. In addition, account options are currently restricted, with no SIPP or JISA available, though this may change in the future.

Overall, Trading 212 is a strong choice for cost‑conscious investors seeking simplicity and accessibility. (Capital at risk.)

Our Pick for a Junior ISA: Hargreaves Landsdowne

Another account type is the Junior ISA. Remember, it's not an investment in itself; you'll still need to choose which assets to hold inside your Junior ISA.

Usually, Hargreaves Lansdown is quite expensive, as it charges dealing fees when you purchase investments. However, for their Junior ISA, there are no fees at all.

It’s just not the most user‑friendly platform to use.

Our pick for a SIPP: Tough one

When looking at fees, InvestEngine takes the top spot. Downsides are that it only has six Islamic ETFs, no sukuk funds, and no physical commodity funds as far as we can see. It’s also not the most user‑friendly, but investing is a long‑term game - you’ll learn as you go.

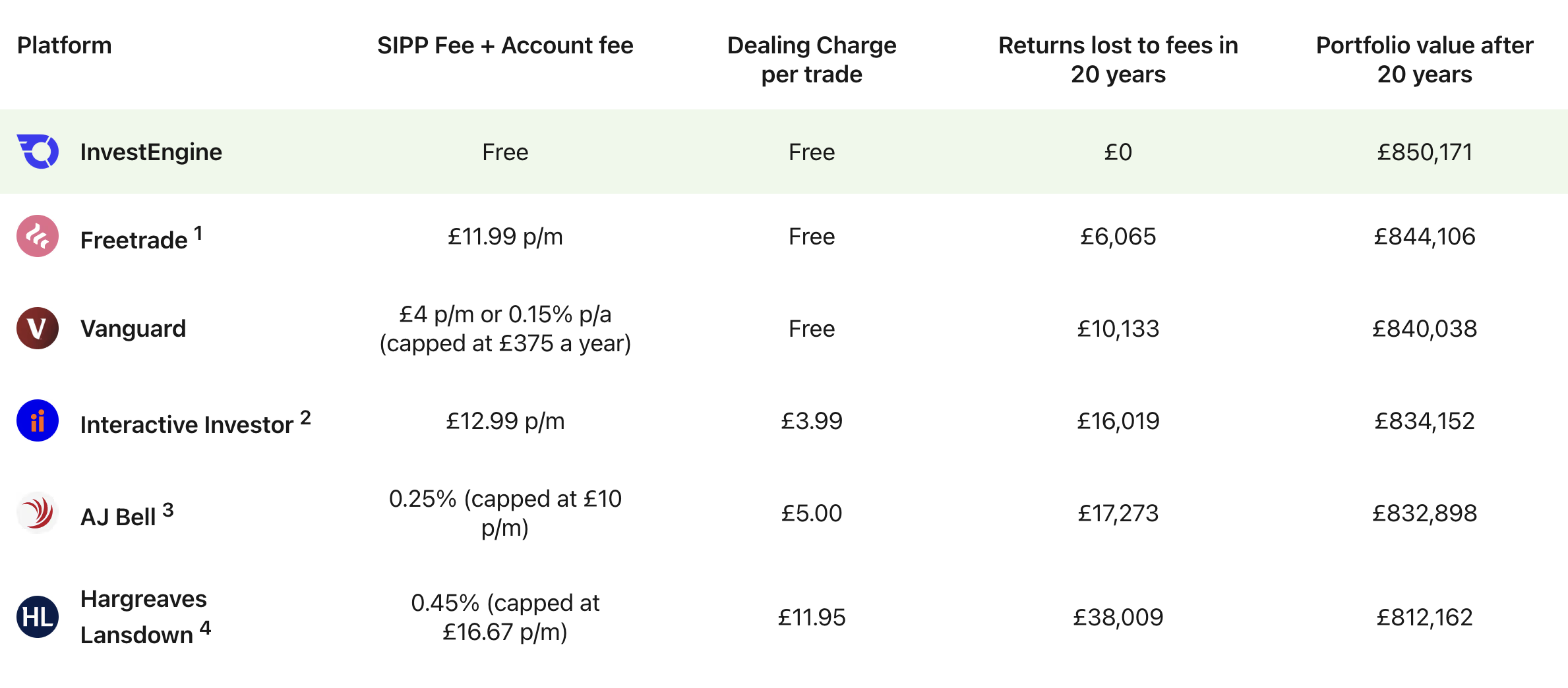

You can see how their costs compare to other providers. It’s worth noting this data comes from their own website, so naturally it’s displayed to portray the best outcome for them.

AJ Bell is more expensive but offers a much wider choice of funds and ETFs, including commodity funds. The other advantage of AJ Bell is that, as they also have a Junior ISA, you can manage your account and your children’s investments with fewer logins and passwords.

One to think about.

Are you following our YouTube?

Our latest video goes through Islamic Saving Accounts and how they work.

|

Ok now back to the rest of this newsletter

Changes in the Islamic Finance Space

Cur8 Capital has made two fairly significant changes in recent weeks.

- You can no longer split your contribution. As their minimum investment is £5,000, many people liked the option of splitting this over three months - that feature has now gone. As their funds have increased in size, it seems they’re targeting larger investors. The change likely reduces admin workload and simplifies operations.

- They’ve also adjusted their GBP Income Fund returns from a compelling 7.5% (7.25% for non‑members) down to 7% (6.75% for non‑members). This aligns with the broader trend of falling interest rates and cheaper capital. A bit of a shame as this an attractive yield and it could also go inside the the IF-ISA meaning all returns are tax free.

Gold and Silver

Both gold and silver have performed impressively recently - but are they part of your long‑term plan, or are you investing out of FOMO?

Below are two charts showing the performance of gold and silver over roughly the past 60 years.

Gold

Silver

In both cases, prices have risen significantly overall. However, if you look closely, there were long stretches where values remained flat or even declined. For example, if you had invested near the highs of the 1980s, you would have waited nearly 31 years to see positive returns on silver, and gold experienced a similar 20‑year drawdown period.

There are many reasons behind recent gains - geopolitical instability, a weakening dollar, and rising industrial demand for silver in modern technologies, to name a few. While these factors are valid, they don’t guarantee that prices will behave rationally going forward.

This isn’t investment advice or a warning to avoid gold and silver. It’s simply a reminder that these are volatile assets. If you have short‑term financial goals or will need access to your funds soon, it can be very difficult to predict how much your investment might grow or shrink in the near term.

Thanks for reading

Jzk

Ahmad & Adel

Responses