Last night my home was broken into...

It seems everyone knows someone who has been burgled and has a story to share. It reminded me of when people used to talk about crypto more. It seemed at the time, and maybe still, that everyone knows someone who made a fortune out of crypto. It was just never the person you spoke to, a friend of a friend, usually.

Perhaps it’s these investing stories that make people get excited. Maybe they could be the next investing millionaire.

Alas, I will add my story to those who have been burgled, but not to those who became crypto millionaires.

But why? Why am I not a crypto millionaire? I’ve been investing for many years. I think hardly a day has gone by over the past two decades where investing hasn’t come up. Of course, crypto was part of that.

The early (I say “early,” but I mean 2017-ish) days of crypto were a minefield, filled with scams and coins that would burn up or triple in a day. “Investing” in crypto back then was more akin to gambling. Though I didn’t come out with millions, I certainly came out wiser.

The lessons I carry from those days still live with me: diligence, proper method, and diversification. Combined with working in the industry for over 15 years, completing my CFA, and becoming a financial adviser, I hope that comes across in how and what we teach.

Fees, what fees?

I don’t like fees, but sometimes they are worth it. After all, we at Nisba charge for in-depth education, in a way, that’s a fee.

But the fees I really don’t like are the hidden ones. The ones you have to dig around to find.

It might be like that time you bought a gold bar from a shop and assumed you were paying the actual price of gold. Na-uh. Everyone takes their little cut along the way, from the refinery to the packaging to the shopkeeper. Seldom do they say, “The price of gold is X, and you are paying X + Y.” It’s just assumed.

So let’s look at two cases of fees and see which you prefer.

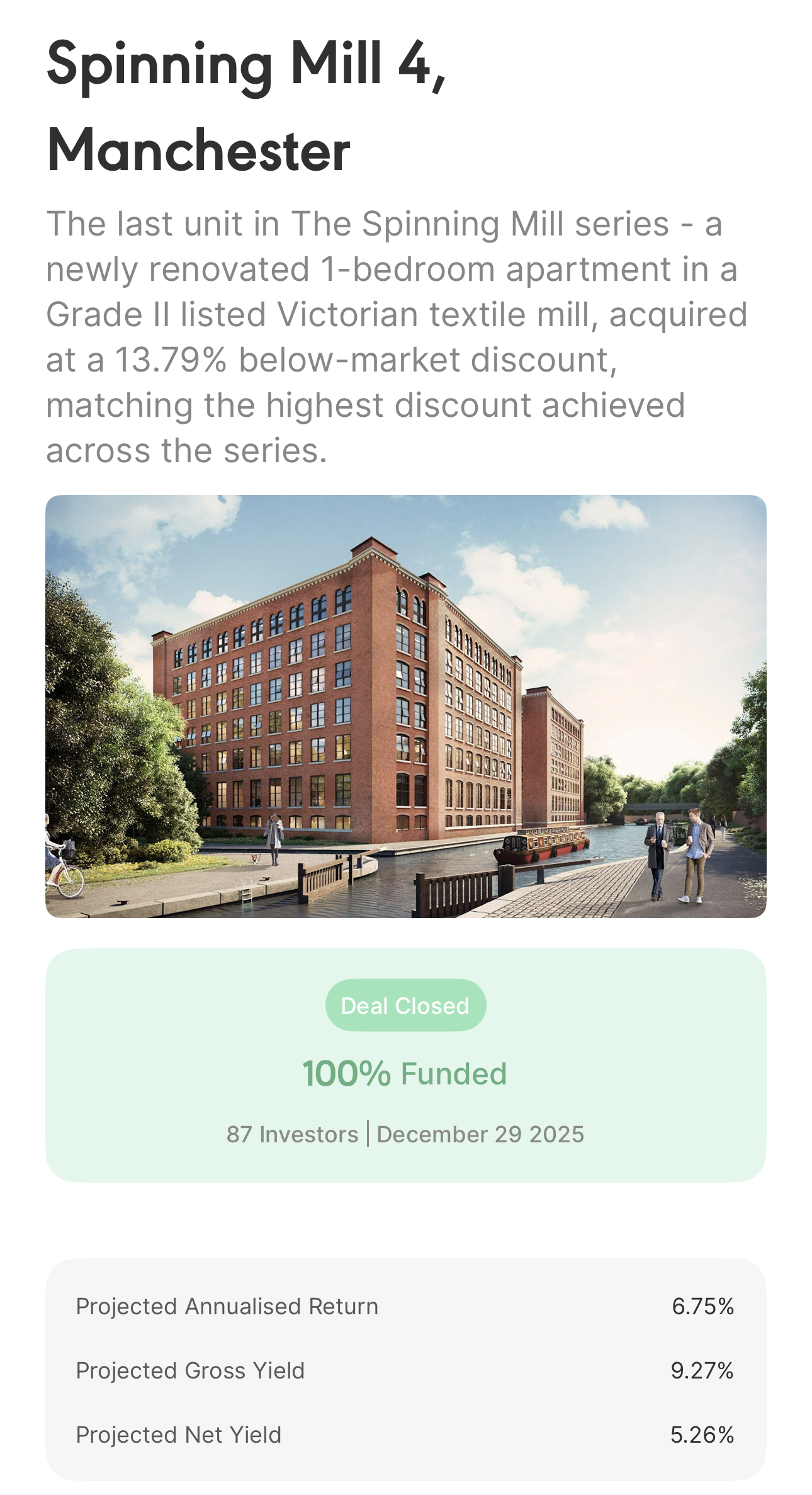

Wahed Property Investing

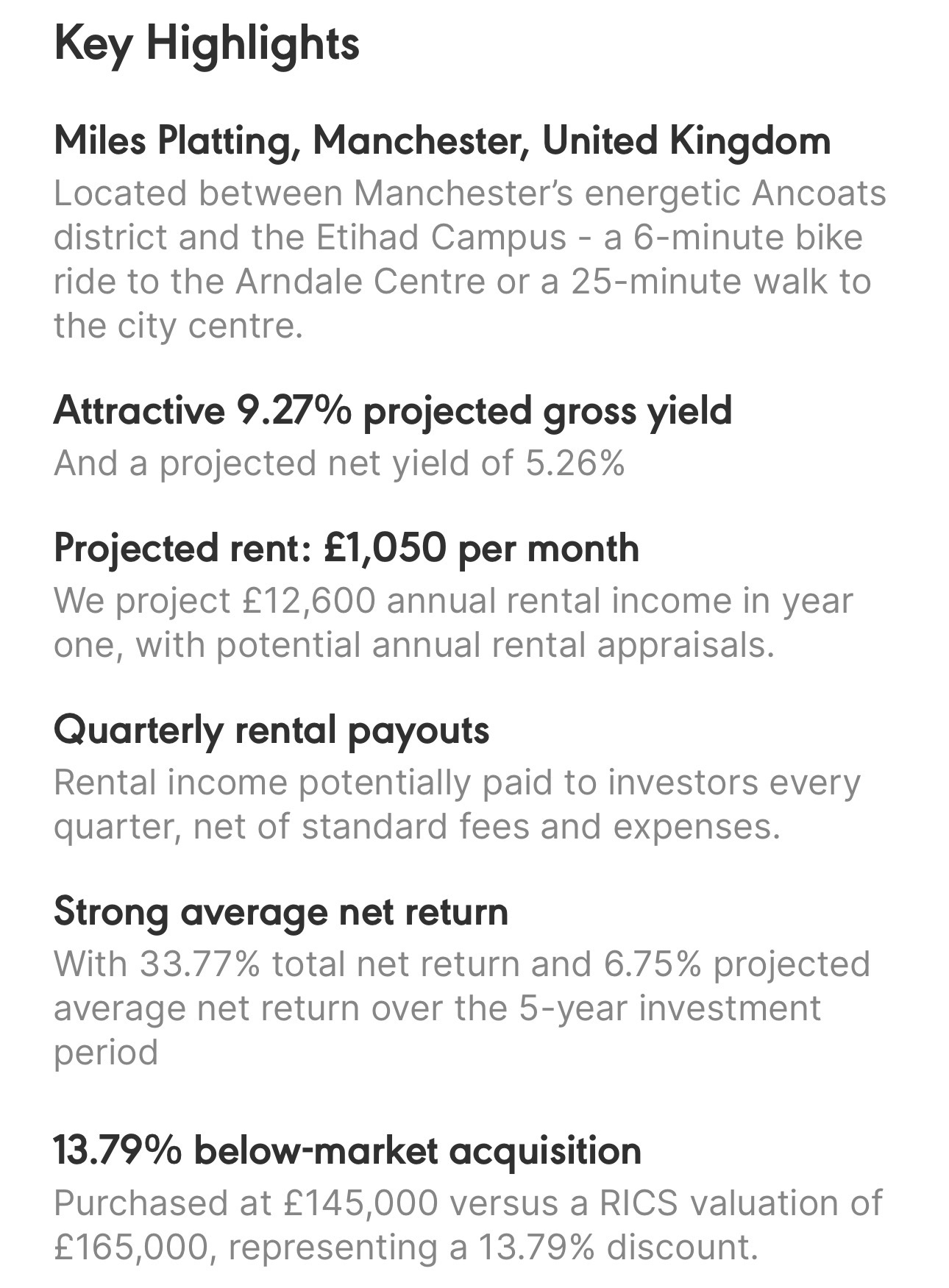

Here we have a property in Manchester, acquired 13.79% below market value. A good bargain if I ever saw one.

There are some returns underneath to help me understand what this investment may return: 6.75%, 9.27%, and 5.26%. Confusing, unless you understand gross and net yields.

Again in the "Key Highlights" we see, the attractive 9.27% yield, and the much tamer 5.26% net yield. But at least you’re getting the property at a steep discount to market value.

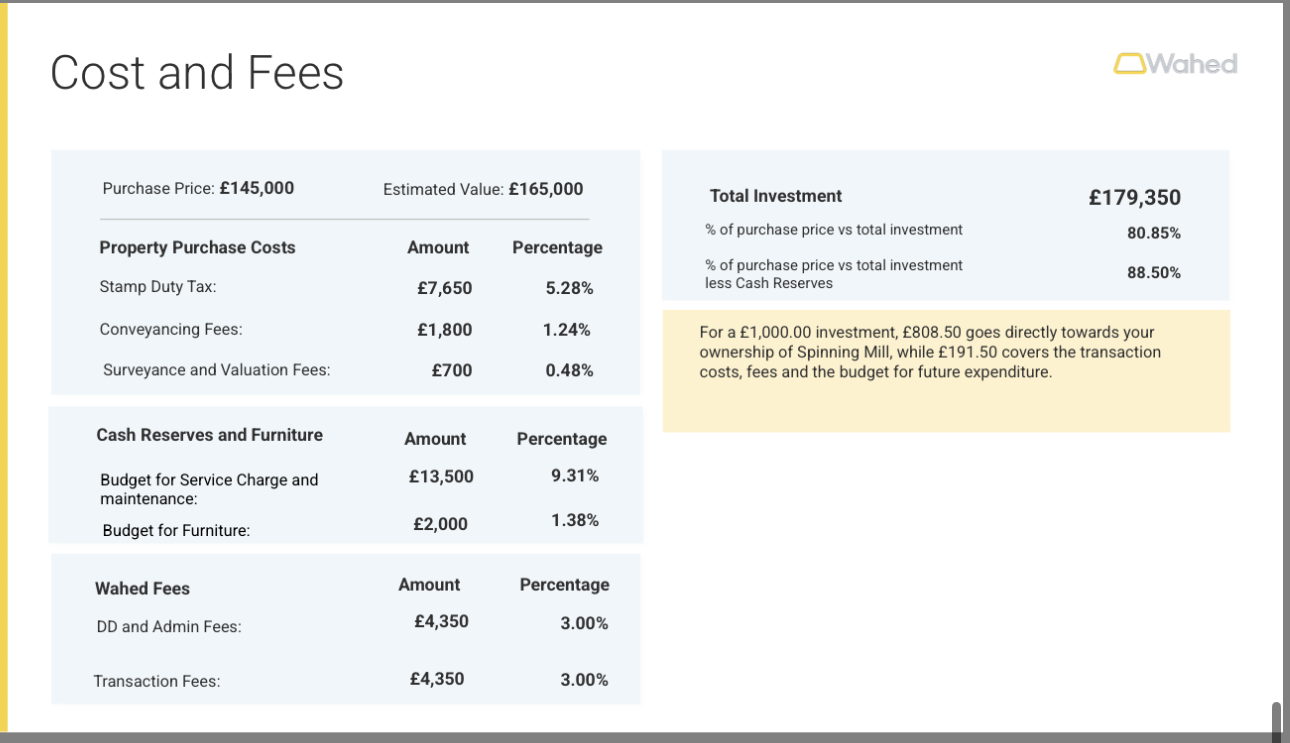

If you look a bit deeper through the documents, the total investment is £179k for a property purchased for £145k. There’s that pesky stamp duty, but also Wahed fees of £8,700, a cool 6% of the purchase price.

All those extra costs together mean that for each £1,000 invested, only 80.85% actually goes towards the property (see the yellow box).

This analysis could be long, but I want to move on. The parting thought is: do the fees matter if you are getting the return you want?

If you pay 10% in fees for a 20% return, would you care? Maybe that net expected return is all that matters. It’s clear enough, right?

Mind you, at least Wahed breaks this down so you can find it. Bayuti doesn’t. Or maybe I just didn’t look hard enough.

Some good fees? Prosper

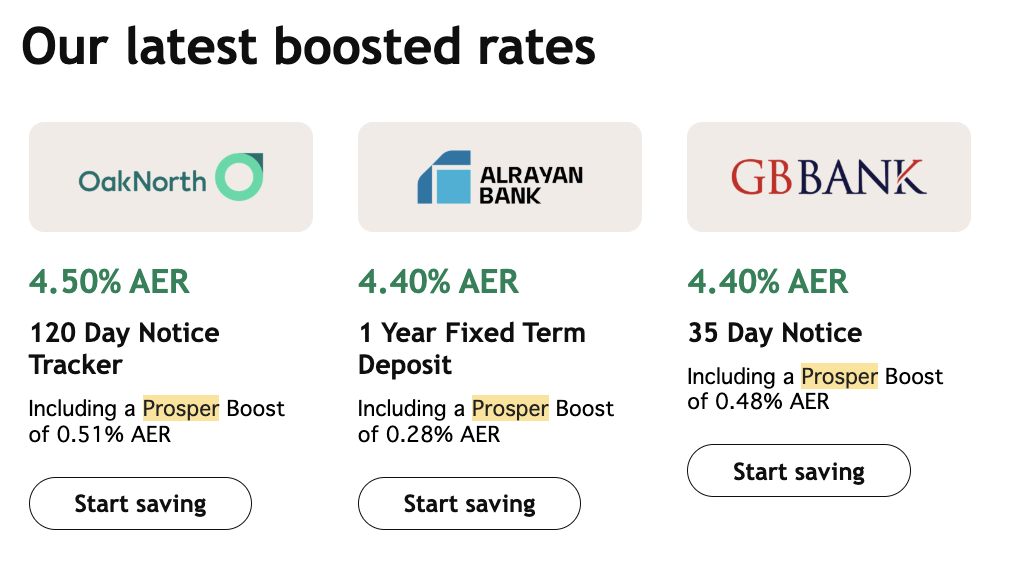

When platforms such as Raisin show you a savings account, the understanding is that there are no fees. So how do they make money?

Well, there’s a cut that Raisin takes. They just don’t show you.

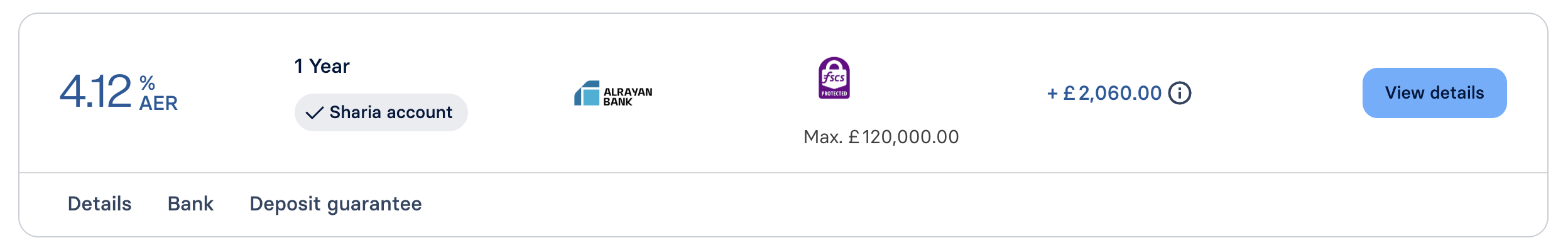

Some firms, like Prosper, pay back these fees, and perhaps some extra too. The 1-year fixed Al Rayan account with Raisin is 4.12%.

That 0.28% bonus that Prosper is offering is real.

Maybe it’s time I stopped using Raisin. Then again, I don’t have a 1-year fixed account and have no need for one at the moment. But if I did… I know it’s worth shopping around. Now you know too.

So the likes of Raisin and Bayuti don’t charge fees, but they do, you just don’t see them.

Well done to Wahed for actually showing the fees. But now I’m left slightly unhappy with both choices. Maybe I should just be happy with both.

Markets are a bit scary recently

If you were invested during Covid, that was a scary time. Your first big dip is usually the one you fear most.

I can’t imagine how it felt during the 2008 financial crisis. I was just coming out of university then and only had a few pounds to my name. If only I had the hindsight to catch the dip.

Can you catch the dip?

There’s a saying that used to go around when I worked as a broker: don’t try to catch a falling knife.

But there are things you can do to try and capitalise on major drops, in a way that makes sense. Strategic asset allocation. Moving within your allocation (still in line with your goals and risk appetite) to pick up certain assets cheaper. It's a good one to search, "strategic asset allocation", incase you want to learn more!

Don’t expect easy wins though.

I thought I did well picking up silver when it dropped from $120 an ounce to $90, only for it to fall into the $70s.

Time will tell.

Wow what an amazing 1 year return, and it's getting better!

If we measure 1-year returns, we measure from one year ago today. If the market happened to drop dramatically a year ago, and we’ve had even a partial recovery since, it makes 1-year returns look amazing.

That’s what’s happening now.

It’s a great opportunity for people to say, “My portfolio has grown 50% in a year.”

It may be true. But in reality, they probably didn’t start investing exactly one year ago, right at the bottom. They were likely invested before that, saw their portfolio drop 30%, and are now seeing the recovery.

Markets are full of ways to make things look exciting. It’s good to understand how it works in reality.

Nisba news

Community

We made a small (big?) announcement that we were moving our community from WhatsApp to Discord.

Now we’re moving again, to Telegram. Inshallah, that’s the last move.

We noticed issues with Discord and its complexity.

Come join the 128 of us on Telegram:

https://t.me/nisbainvest

Don’t forget to enter your submission for the Nisba Ramadan competition before Ramadan begins. See the Nisba Challenges group within Telegram. Hoodie and book up for grabs. Maybe something else too!

We have an office now

Calling it an office is a bit of a stretch, it’s more of an average-sized room. More akin to a prison cell. But I like it.

Maybe we should have an office launch party. I think we could fit 10 people before it gets too cosy.

But onwards and upwards. Alhamdulillah for all eventualities.

Should we do stuff in Ramadan?

We’ve opted not to run events in Ramadan, but you might catch us on some live streams.

We’re going to try and improve the quality of our content. I think sometimes our filming and sound are a bit… potato quality.

Everyone starts somewhere.

Islam Channel

I don’t watch this channel, but maybe you do.

If you do, we’re live on Tuesday at 11am apparently. Make sure you tell Islam Channel you loved our segment.

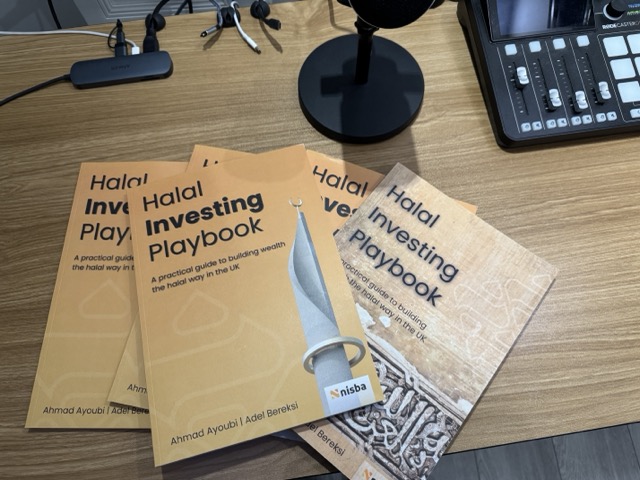

The Playbook

The Halal Investing Playbook we wrote is starting to be packed and sent out. I think Adel is posting some this weekend.

If you want to give him more work, learn how to practically start investing in a halal way, and support us to grow, I would recommend it.

Might I add… it would make a great Eid present 😉

Jzk for reading,

Ahmad & Adel

Responses