Halal Bitcoin, a Silver Giveaway, Cur8 Rasmala Fund Problems, Popular Stocks

This Week at Nisba

-

The most popular stocks on AJ Bell in 2025, have people actually made money?

-

A Shariah-compliant Bitcoin fund, halal or controversial?

-

Shariah-compliant commodity funds (beyond gold and silver)

-

Issues with the Cur8 Capital / Rasmala Property (VLF) fund

-

Nisba: Intro to Halal Investing Event (Monday 22nd February)

-

Nisba hoodies, now on sale

-

Competition: win a bar of silver and a Nisba hoodie

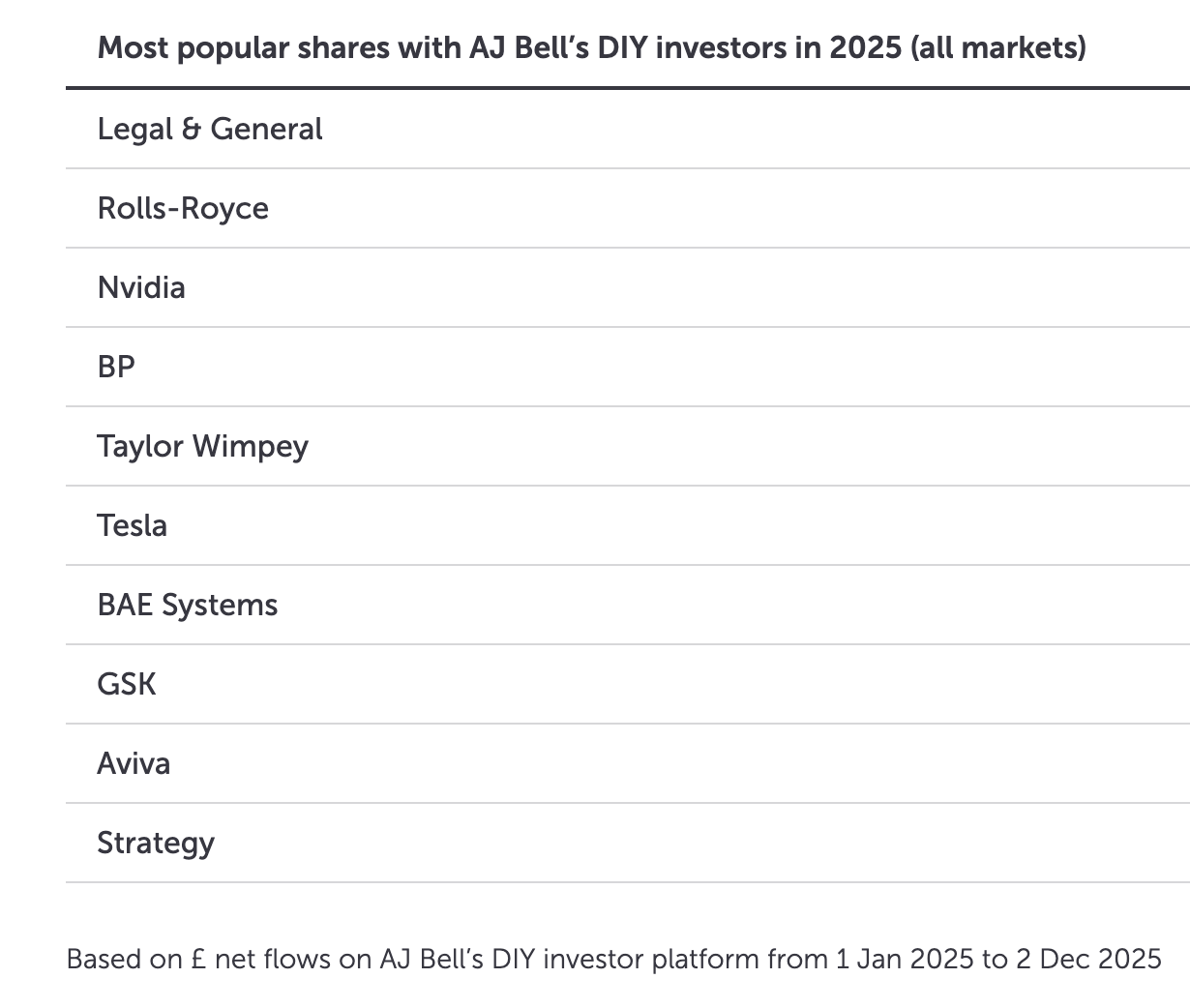

AJ Bell recently shared the most popular shares bought on their platform in 2025.

Here’s how those shares have performed so far:

Lets see how theyve done (approx numbers):

- Rolls-Royce: up 91%

- BAE Systems: up 46.7%

- Aviva: up 41.06%

- GSK: up 35.56%

- Nvidia: up 26.54%

- Tesla: up 13.65%

- BP: up 12%

- Legal & General: up 6.9%

- Taylor Wimpey: down 21%

So… does this mean people are great at picking stocks?

Or is it more likely that people pile into shares after they’ve already gone up?

You tell me.

It’s easy to sound like a genius after a stock has already risen. Personally, I’m not in the business of trying to predict which stock will do well next year. A diversified portfolio will usually have some winners and some losers, and that’s perfectly normal.

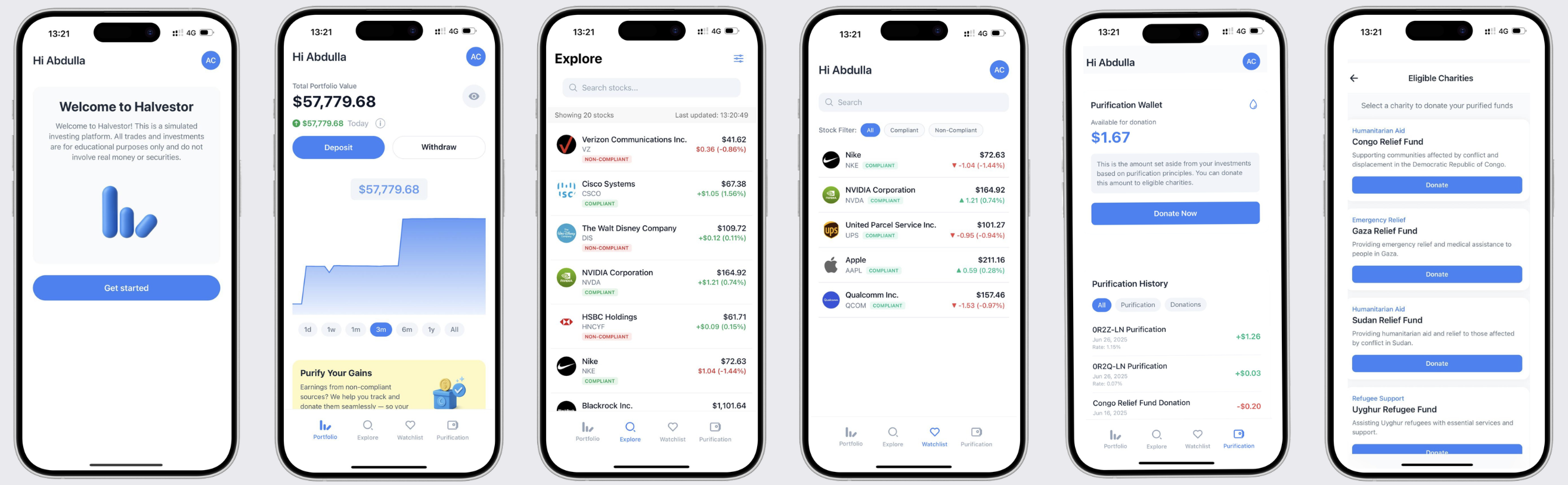

Halvestor, the sponsor of todays newsletter!

Halvestor have launched a new app that lets you simulate investing in stocks in a Shariah-compliant way, using simulated money.

If you’re lacking confidence, still learning, or want to test a strategy for buying and selling shares without risking real capital, this is worth checking out.

The app is still relatively new, and the first 500 users will receive:

-

Early access to live halal trading (when it launches)

-

A Founding User profile badge

-

A free 1:1 call with the founder to better understand how to use the Halvestor paper-trading platform

-

Exclusive access to the Halvestor Hub community

The app is free, and we’ve spent some time exploring it ourselves. It’s a solid starting point, and we’re interested to see how it develops over time.

Check the out here: https://www.halvestor.com/

Shariah Compliant Bitcoin Fund?

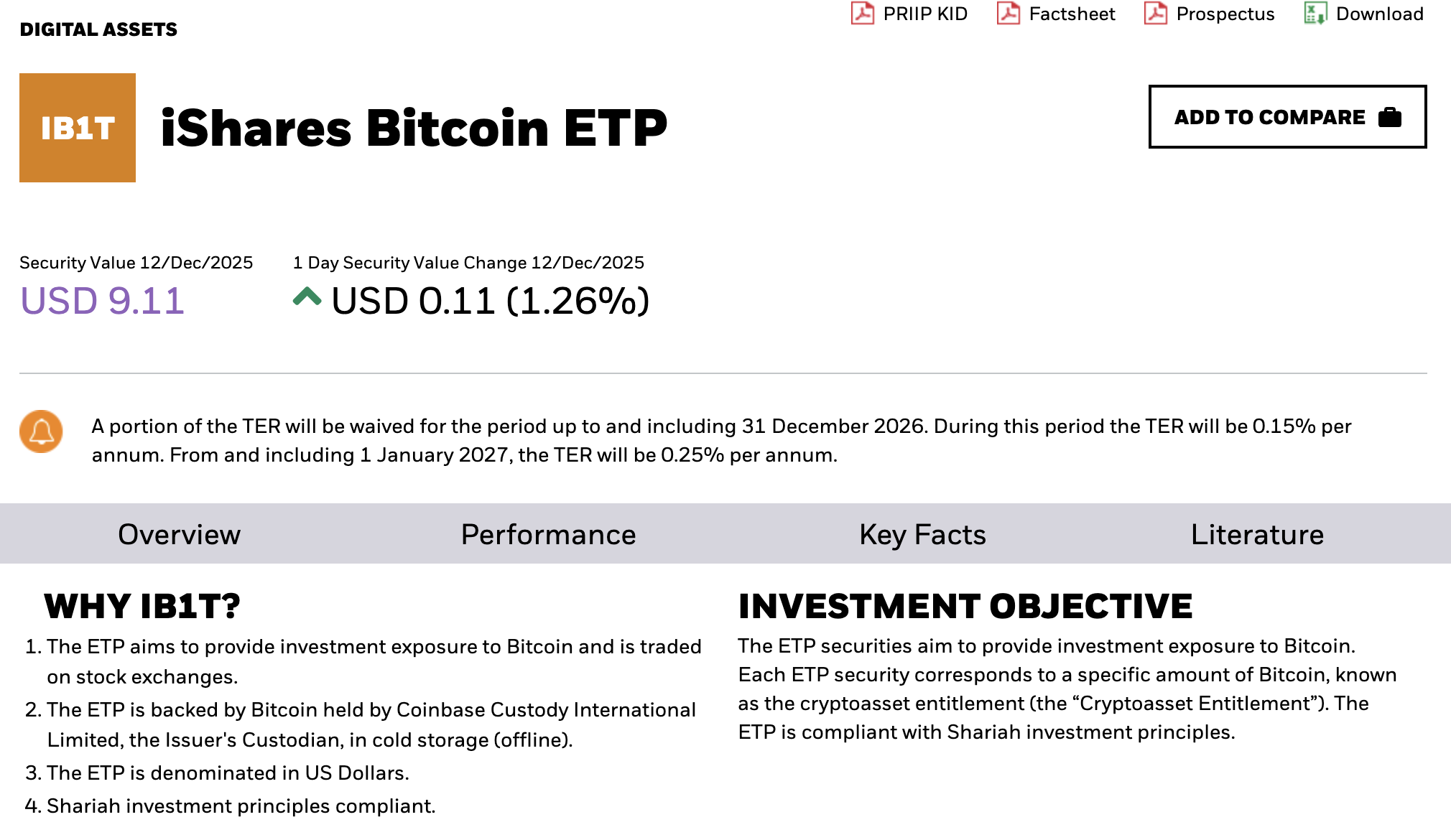

IB1T is being marketed as a Shariah-compliant Bitcoin fund. Unsurprisingly, not everyone agrees on this one.

If you want exposure to Bitcoin, iShares (BlackRock) state on their website that this fund is Shariah-compliant (see point 4 on the image we shared).

Because it’s a fund, there are annual fees, but it does remove the risk of holding crypto on an exchange. Some people argue the best place for crypto is a cold wallet. That’s valid, but it does require a bit of technical confidence.

One important thing to be aware of:

There are potential regulatory changes that may prevent crypto funds from being held inside a Stocks & Shares ISA. If that happens, holdings may need to be liquidated from April 2026.

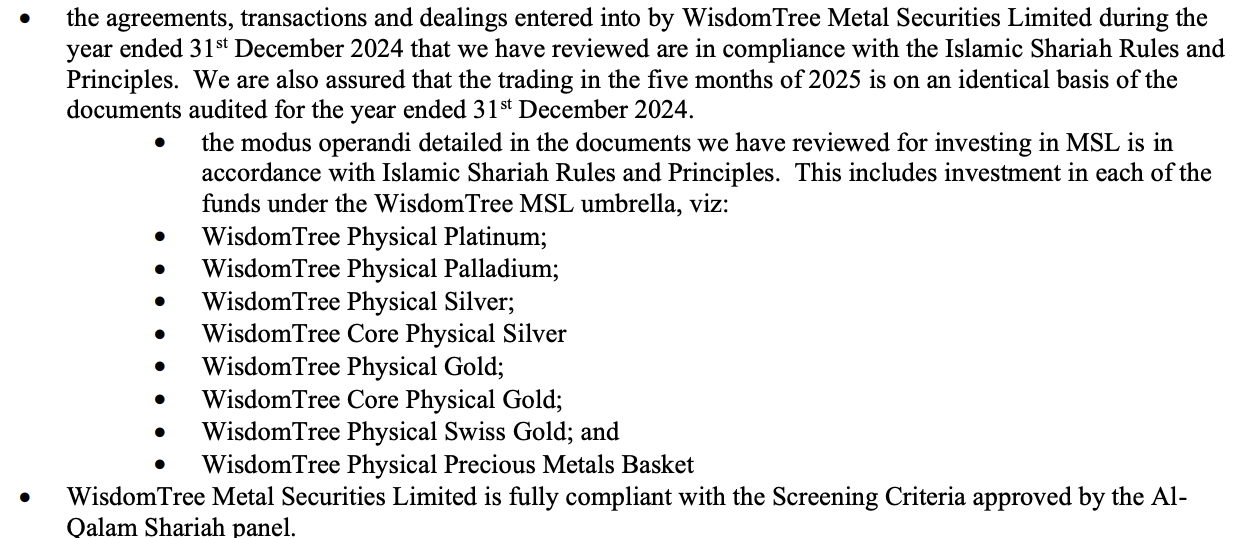

Shariah-Compliant Commodity Funds (Beyond Gold & Silver)

Some commodity funds have been performing extremely well recently.

We came across a number of more niche Shariah-compliant commodity funds from WisdomTree, covering areas beyond just gold and silver.

We checked and they are available on Trading 212.

Should you buy them?

It depends.

Commodity exposure can make sense in certain portfolios, but it depends on your goals, time horizon, and overall asset allocation.

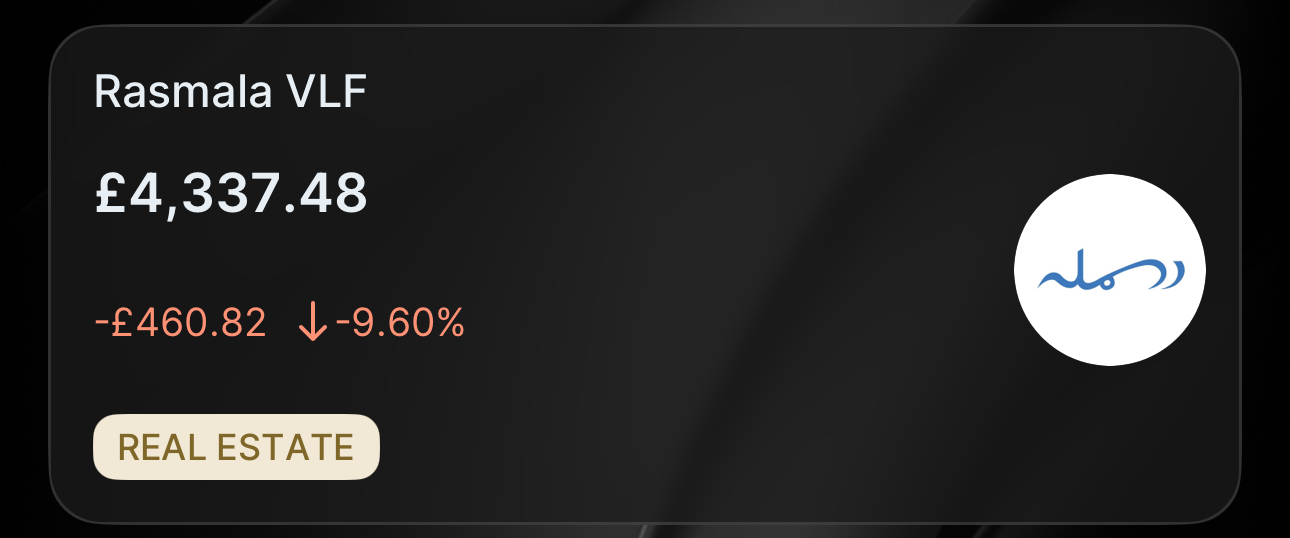

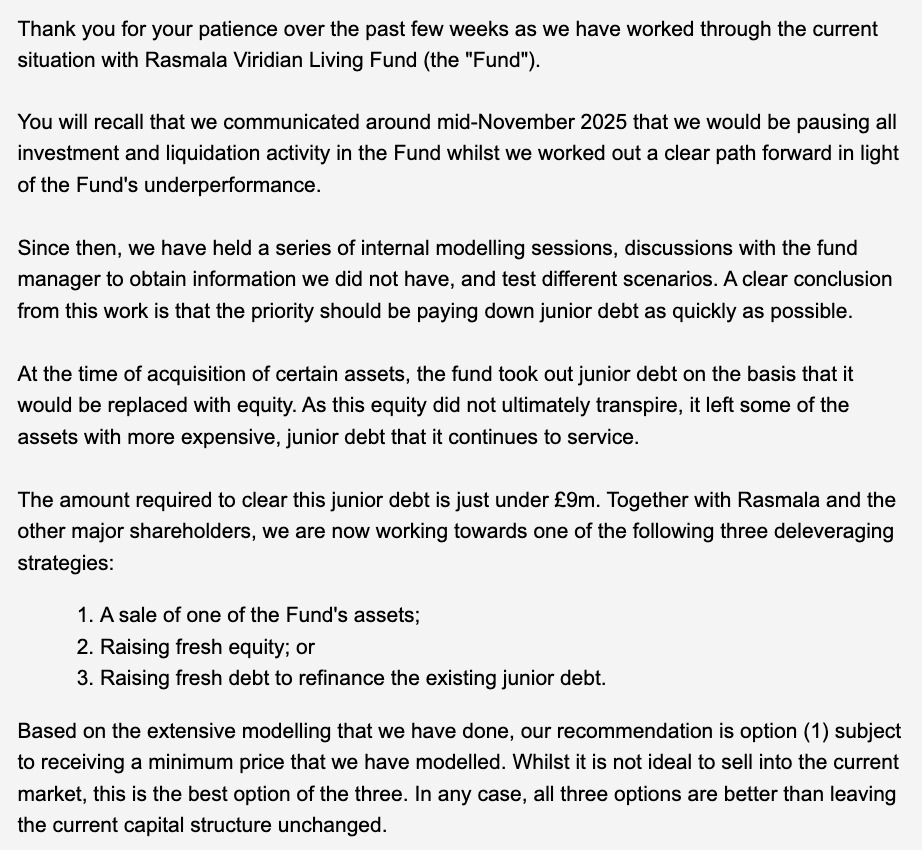

Cur8 Capital: Issues with the Rasmala Property Fund (VLF)

To be fair to Cur8 Capital, communication around this has been fairly transparent.

We’ve heard from several people (including within our own portfolio) that the Rasmala Property VLF fund hasn’t performed as expected. Things can often look very attractive before you invest.

Returns are currently down around 10–20%, depending on when you invested.

See below email:

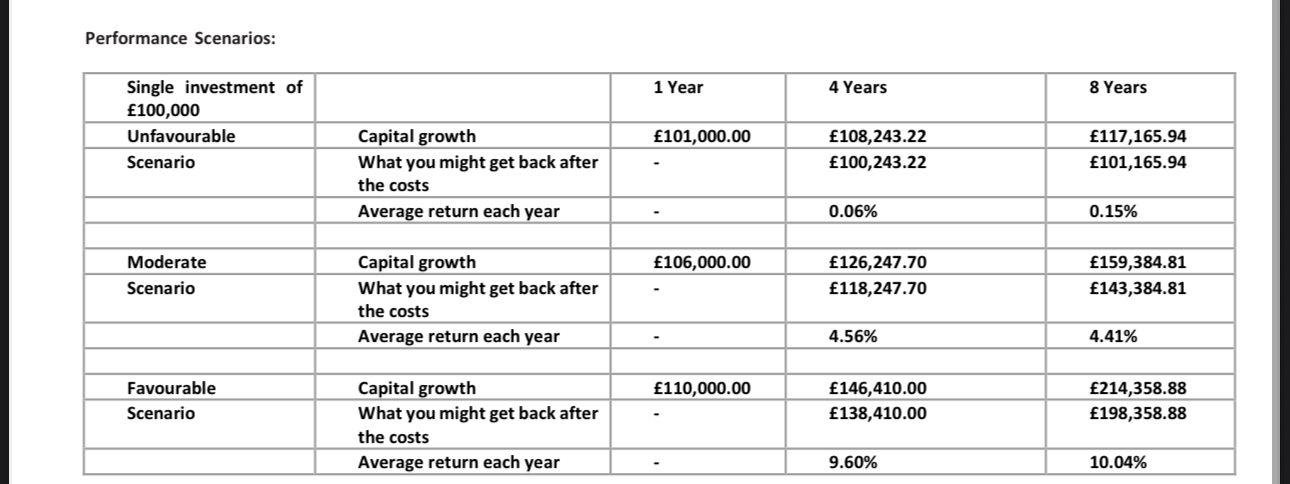

What’s concerning is that the Key Information Document (KID) showed that even in an unfavourable scenario, returns were expected to be slightly positive.

This is a reminder that investing comes with risk.

Remeber, investing comes with risk. It this drop too much too fast? We are doing our investigations!

Nisba has an Intro to Halal Investing Event Coming up

We’re running a live Intro to Halal Investing session:

🗓 Monday 22nd February

⏰ 9:00pm (UK)

If you’re new to investing, confused about what’s halal, or want a structured starting point, this is for you.

👉 Sign up here: https://www.nisba.co.uk/events

Hoodies on sale

Our Nisba hoodies are officially live.

If you want to support what we’re building and represent the community, you can grab yours here.

Win a Bar of Silver & a Nisba Hoodie

We’re running a competition to celebrate the launch of the new Nisba community on our Kajabi platform.

Prizes:

-

🪙 A bar of silver

-

👕 A Nisba hoodie

We’ve been using WhatsApp as our community space for a while, but with over 1,000 members, it’s getting messy. InshaAllah, we’ll keep experimenting until we find the perfect long-term home.

👉To enter the competiton, sign upto nisba club (its free) here.

New YouTube Video: Sukuk Funds

If you haven’t seen it yet, we’ve just released a new YouTube video explaining Sukuk funds – how they work, risks, returns, and when they may (or may not) make sense.

|

Oh that's all folks, a quick reminder that nisba academy is starting on the 23rd of December, check out our site for detials, we expect to sell out so get in early to avoid dissapointment. I hope this newsletter has been useful, keep us in your duas. See you next time inshaAllah.

Jzk

Ahmad, Adel & the nisba team

Responses